Features¶

Specifications¶

First block mined at 11PM EST, 18th January 2014

No premine

X11 hashing algorithm, CPU/GPU/ASIC mining available

2.6 minute block time, 2MB blocks, ~56 transactions per second

Block reward decreases by 7.14% per year

Dark Gravity Wave difficulty adjustment algorithm

Between 17.74M and 18.92M total coin supply

Decentralized second-tier masternode network

Superior privacy using CoinJoin

Instant transactions using InstantSend

Protection against blockchain reorganization events (commonly called 51% attacks) using ChainLocks

Decentralized Governance By Blockchain allows masternode owners to vote on budget proposals and decisions that affect Dash

Masternodes¶

In addition to traditional Proof of Work (PoW) rewards for mining Dash, users are also rewarded for running and maintaining special servers called masternodes. Thanks to this innovative two tier network, Dash can offer innovative features in a trustless and decentralized way. Masternodes are used to power CoinJoin, InstantSend, and the governance and treasury system. Users are rewarded for running masternodes; a percentage of the block reward is allocated to pay the masternode network. The current percentage can be found in this table. You can view practical guides on all topics relating to masternodes here.

Masternodes enable the following services:

InstantSend allows for near-instant transactions. Dash InstantSend transactions are fully confirmed within two seconds.

CoinJoin gives financial privacy through a decentralized implementation of CoinJoin.

ChainLocks, which protects the blockchain against 51% mining attacks by signing blocks as they are mined.

Governance and Treasury allows stakeholders in Dash to determine the direction of the project and devotes 10% of the block reward to development of the project and ecosystem.

Dash Evolution will make using cryptocurrency as easy as using PayPal.

Masternode owners must have possession of 1000 DASH, which they prove by signing a message included in a special transaction written to the blockchain. The Dash can be moved or spent at any time, but doing so will cause the masternode to fall out of queue and stop earning rewards. Masternode users are also given voting rights on proposals. Each masternode has one vote and this vote can be used on budget proposals or important decisions that affect Dash.

Masternodes cost money and effort to host so they are paid a percentage of the block reward as an incentive. Because only one masternode is paid in each block, the frequency of the payment can vary, as well as the value of the Dash paid out. This tool shows a live calculation of masternode earnings. These rewards decrease by 7% each year, together with the block reward. There is also the possibility for masternodes to earn money from fees in the future.

CoinJoin¶

CoinJoin gives you consumer grade financial privacy by shuffling your Dash with other users. All the Dash in your wallet consists of different inputs, which you can think of as separate, discrete coins. It uses an innovative process to join your inputs with the inputs of at least two other people in a single transaction, so the value in Dash never leaves your wallet. You retain control of your money at all times.

You can view a practical guide to use CoinJoin here.

The CoinJoin process works like this:

CoinJoin begins by breaking your transaction inputs down into standard denominations. These denominations are 0.001, 0.01, 0.1, 1 and 10 Dash – much like the paper money you use every day.

Your wallet then sends requests to specially configured software nodes on the network called masternodes. These masternodes are informed then that you are interested in creating a certain denomination using CoinJoin. No identifiable information is sent to the masternodes, so they never know who you are.

When two other people send similar messages, indicating that they wish to join coins of the same denomination, a session begins. The masternode instructs all three users’ wallets to pay the now-transformed inputs to themselves. Your wallet pays that denomination directly to itself but in a different address (called a change address).

Your wallet can repeat this process a number of times with each denomination. Each time the process is completed it’s called a “round.” The user may choose between 2-16 rounds of CoinJoin.

Your funds will pass through at least the number of rounds you specify. Dash 0.16 includes an update known as Random Round CoinJoin which will join a given denomination by up to three extra rounds to further improve privacy.

This process happens in the background without any intervention on your part. When you wish to make a transaction using your denominated funds no additional waiting will be required.

Note that CoinJoin transactions will be rounded up so that all transaction inputs are spent. Any excess Dash will be spent on the transaction fee.

IMPORTANT: Your wallet only contains 1000 of these change addresses. Every time a CoinJoin transaction is created, one of your addresses is used up. Once enough of them are used, your wallet must create more addresses. It can only do this, however, if you have automatic backups enabled. Consequently, users who have backups disabled will also have CoinJoin disabled.

InstantSend¶

Traditional decentralized cryptocurrencies must wait for certain period of time for enough blocks to pass to ensure that a transaction is both irreversible and not an attempt to double-spend money which has already been spent elsewhere. This process is time-consuming, and may take anywhere from 15 minutes to one hour for the widely accepted number of six blocks to accumulate. Other cryptocurrencies achieve faster transaction confirmation time by centralizing authority on the network to various degrees.

Dash suffers from neither of these limitations thanks to its second-layer network of masternodes. Masternodes regularly form voting quorums to check whether or not a submitted transaction is valid. If it is valid, the masternodes “lock” the inputs for the transaction and broadcast this information to the network, effectively promising that the transaction will be included in subsequently mined blocks and not allowing any other spending of these inputs during the confirmation time period.

InstantSend technology will allow for cryptocurrencies such as Dash to compete with nearly instantaneous transaction systems such as credit cards for point-of-sale situations while not relying on a centralized authority. Widespread vendor acceptance of Dash and InstantSend could revolutionize cryptocurrency by shortening the delay in confirmation of transactions from as long as an hour (with Bitcoin) to as little as a few seconds.

You can view a practical guide to use InstantSend here. InstantSend was introduced in a whitepaper called Transaction Locking and Masternode Consensus: A Mechanism for Mitigating Double Spending Attacks, and further improved through the introduction of LLMQ-based InstantSend in Dash 0.14.

How Dash ‘InstantSend’ Protects Merchants from Double Spends, Dash Detailed by Amanda B. Johnson, 16 September 2016

ChainLocks¶

ChainLocks are a feature provided by the Dash Network which provides certainty when accepting payments. This technology, particularly when used in parallel with InstantSend, creates an environment in which payments can be accepted immediately and without the risk of “Blockchain Reorganization Events”.

The risk of blockchain reorganization is typically addressed by requiring multiple “confirmations” before a transaction can be safely accepted as payment. This type of indirect security is effective, but at a cost of time and user experience. ChainLocks are a solution for this problem.

ChainLocks Process Overview¶

Every twelve hours a new “LLMQ” (Long-Living Masternode Quorum) is formed using a “DKG” (Distributed Key Generation) process. All members of this Quorum are responsible for observing, and subsequently affirming, newly mined blocks:

Whenever a block is mined, Quorum Members will broadcast a signed message containing the observed block to the rest of the Quorum.

If 60% or more of the Quorum sees the same new block they will collectively form a “CLSIG” (ChainLock Signature) message which will be broadcast to the remainder of the network.

When a valid ChainLock Signature is received by a client on the network, it will reject all blocks at the same height that do not match the block specified in that message.

The result is a quick and unambiguous decision on the “correct” blockchain for integrated clients and wallets. From a security perspective, this also makes reorganizations prior to this block impossible. See DIP0008 ChainLocks for a full description of how ChainLocks work.

Sporks¶

In response to unforeseen issues with the rollout of the major “RC3” update in June 2014, the Dash development team created a mechanism by which updated code is released to the network, but not immediately made active (“enforced”). This innovation allows for far smoother transitions than in the traditional hard fork paradigm, as well as the collection of test data in the live network environment. This process of multi-phased forking was originally to be called “soft forking” but the community affectionately dubbed it “the spork” and the name stuck.

New features or versions of Dash undergo extensive testing on testnet before they are released to the main network. When a new feature or version of Dash is released on mainnet, communication is sent out to users informing them of the change and the need for them to update their clients. Those who update their clients run the new code, but it is not activated until a sufficient percentage of network participants (usually 80%) reach consensus on running it. In the event of errors occurring with the new code, the client’s blocks are not rejected by the network and unintended forks are avoided. Data about the error can then be collected and forwarded to the development team. Once the development team is satisfied with the new code’s stability in the mainnet environment – and once acceptable network consensus is attained – enforcement of the updated code can be activated remotely by multiple members of the core development team signing a network message together with their respective private keys. Should problems arise, the code can be deactivated in the same manner, without the need for a network-wide rollback or client update. For technical details on individual sporks, see here.

X11 Hash Algorithm¶

X11 is a widely used hashing algorithm created by Dash core developer Evan Duffield. X11’s chained hashing algorithm utilizes a sequence of eleven scientific hashing algorithms for the proof-of-work. This is so that the processing distribution is fair and coins will be distributed in much the same way Bitcoin’s were originally. X11 was intended to make ASICs much more difficult to create, thus giving the currency plenty of time to develop before mining centralization became a threat. This approach was largely successful; as of early 2016, ASICs for X11 now exist and comprise a significant portion of the network hashrate, but have not resulted in the level of centralization present in Bitcoin. Information on mining with X11 can be found in the Mining section of this documentation.

X11 is the name of the chained proof-of-work (PoW) algorithm that was introduced in Dash (launched January 2014 as “Xcoin”). It was partially inspired by the chained-hashing approach of Quark, adding further “depth” and complexity by increasing the number of hashes, yet it differs from Quark in that the rounds of hashes are determined a priori instead of having some hashes being randomly picked.

The X11 algorithm uses multiple rounds of 11 different hashes (blake, bmw, groestl, jh, keccak, skein, luffa, cubehash, shavite, simd, echo), thus making it one of the safest and more sophisticated cryptographic hashes in use by modern cryptocurrencies. The name X11 is not related to the open source X11 windowing system common on UNIX-like operating systems.

Advantages of X11¶

The increased complexity and sophistication of the chained algorithm provides enhanced levels of security and less uncertainty for a digital currency, compared to single-hash PoW solutions that are not protected against security risks like SPOF (Single Point Of Failure). For example, a possible but not probable computing breakthrough that “breaks” the SHA256 hash could jeopardize the entire Bitcoin network until the network shifts through a hard fork to another cryptographic hash.

In the event of a similar computing breakthrough, a digital currency using the X11 PoW would continue to function securely unless all 11 hashes were broken simultaneously. Even if some of the 11 hashes were to prove unreliable, there would be adequate warning for a currency using X11 to take measures and replace the problematic hashes with other more reliable hashing algorithms.

Given the speculative nature of digital currencies and their inherent uncertainties as a new field, the X11 algorithm can provide increased confidence for its users and potential investors that single-hash approaches cannot. Chained hashing solutions, like X11, provide increased safety and longevity for store of wealth purposes, investment diversification and hedging against risks associated with single-hash currencies plagued by SPOF (Single Point Of Failure).

Evan Duffield, the creator of Dash and X11 chained-hash, has written on several occasions that X11 was integrated into Dash not with the intention to prevent ASIC manufacturers from creating ASICs for X11 in the future, but rather to provide a similar migratory path that Bitcoin had (CPUs, GPUs, ASICs).

Dark Gravity Wave¶

DGW or Dark Gravity Wave is an open source difficulty-adjusting algorithm for Bitcoin-based cryptocurrencies that was first used in Dash and has since appeared in other digital currencies. DGW was authored by Evan Duffield, the developer and creator of Dash, as a response to a time-warp exploit found in Kimoto’s Gravity Well. In concept, DGW is similar to the Kimoto Gravity Well, adjusting the difficulty levels every block (instead of every 2016 blocks like Bitcoin) based on statistical data from recently found blocks. This makes it possible to issue blocks with relatively consistent times, even if the hashing power experiences high fluctuations, without suffering from the time-warp exploit.

Version 2.0 of DGW was implemented in Dash from block 45,000 onwards in order to completely alleviate the time-warp exploit.

Version 3.0 was implemented on May 14 of 2014 to further improve difficulty re-targeting with smoother transitions. It also fixes issues with various architectures that had different levels of floating-point accuracy through the use of integers.

Emission Rate¶

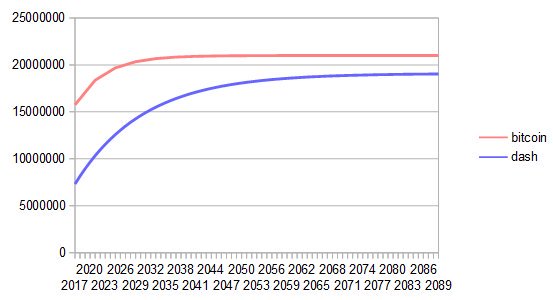

Cryptocurrencies such as Dash and Bitcoin are created through a cryptographically difficult process known as mining. Mining involves repeatedly solving hash algorithms until a valid solution for the current mining difficulty is discovered. Once discovered, the miner is permitted to create new units of the currency. This is known as the block reward. To ensure that the currency is not subject to endless inflation, the block reward is reduced at regular intervals, as shown in this calculation. Graphing this data results in a curve showing total coins in circulation, known as the coin emission rate.

While Dash is based on Bitcoin, it significantly modifies the coin emission rate to offer a smoother reduction in coin emission over time. While Bitcoin reduces the coin emission rate by 50% every 4 years, Dash reduces the emission by one-fourteenth (approx. 7.14%) every 210240 blocks (approx. 383.25 days). It can be seen that reducing the block reward by a smaller amount each year offers a smoother transition to a fee-based economy than Bitcoin.

Bitcoin vs. Dash coin emission rate¶

Total coin emission¶

Bitcoin’s total coin emission can be calculated as the sum of a geometric series, with the total emission approaching (but never reaching) 21,000,000 BTC. This will continue until 2140, but the mining reward reduces so quickly that 99% of all bitcoin will be in circulation by 2036, and 99.9% by 2048.

Dash’s total coin emission is also the sum of a geometric series, but the ultimate total coin emission is uncertain because it cannot be known how much of the 10% block reward reserved for budget proposals will actually be allocated, since this depends on future voting behavior. Dash will continue to emit coins for approximately 192 years before a full year of mining creates less than 1 DASH. After 2209 only 14 more DASH will be created. The last DASH will take 231 years to be generated, starting in 2246 and ending when emission completely stops in 2477. Based on these numbers, a maximum and minimum possible coin supply in the year 2254 can be calculated to be between:

17,742,696 DASH |

Assuming zero treasury allocation |

18,921,005 DASH |

Assuming full treasury allocation |

Block reward allocation¶

Unlike Bitcoin, which allocates 100% of the block reward to miners, Dash holds back 10% of the block reward for use in the decentralized budget system. The remainder of the block reward, as well as any transaction fees, is split between the miner and a masternode, which is deterministically selected according to the payment logic. Dash features superblocks, which appear every 16616 blocks (approx. 30.29 days) and can release up to 10% of the cumulative budget held back over that budget cycle period to the winning proposals in the budget system. Depending on budget utilization, this results in an approximate coin reward allocation over a budget cycle as follows:

90% |

Mining and Masternode Reward |

10% |

Decentralized Governance Budget |

On 13 August 2020, the Dash network approved a proposal to modify the block reward allocation from 50/50 between miners and masternodes to 40/60, respectively. The incremental reallocation adjusts the percentage share every three superblock cycles.

The following table shows the incremental reallocation process and indicates the current reallocation date. Reward reallocation changes began at the first superblock following activation and now occur every three superblock cycles (approximately once per quarter) until the reallocation is complete.

Adjustment |

Miner % |

Masternode % |

Change (%) |

Reallocation Dates |

|---|---|---|---|---|

0 |

50.0 |

50.0 |

0.00% |

— |

1 |

48.7 |

51.3 |

1.30% |

2020-11-28 |

2 |

47.4 |

52.6 |

1.30% |

2021-02-27 |

3 |

46.7 |

53.3 |

0.70% |

2021-05-29 |

4 |

46.0 |

54.0 |

0.70% |

2021-08-28 |

5 |

45.4 |

54.6 |

0.60% |

2021-11-27 |

6 |

44.8 |

55.2 |

0.60% |

2022-02-25 |

7 (Current) |

44.3 |

55.7 |

0.50% |

2022-05-27 |

8 |

43.8 |

56.2 |

0.50% |

2022-08-26 |

9 |

43.3 |

56.7 |

0.50% |

2022-11-25 |

10 |

42.8 |

57.2 |

0.50% |

2023-02-24 |

11 |

42.3 |

57.7 |

0.50% |

2023-05-26 |

12 |

41.8 |

58.2 |

0.50% |

2023-08-25 |

13 |

41.5 |

58.5 |

0.30% |

2023-11-24 |

14 |

41.2 |

58.8 |

0.30% |

2024-02-23 |

15 |

40.9 |

59.1 |

0.30% |

2024-05-24 |

16 |

40.6 |

59.4 |

0.30% |

2024-08-22 |

17 |

40.3 |

59.7 |

0.30% |

2024-11-21 |

18 |

40.1 |

59.9 |

0.20% |

2025-02-20 |

19 |

40.0 |

60.0 |

0.10% |

2025-05-22 |

This documentation is based on calculations and posts by moocowmoo. Please see this reddit post for more details, or run your own emission calculations using this tool. See this site for live data on current network statistics.

Decentralized Governance¶

Decentralized Governance by Blockchain, or DGBB, is Dash’s attempt to solve two important problems in cryptocurrency: governance and funding. Governance in a decentralized project is difficult, because by definition there are no central authorities to make decisions for the project. In Dash, such decisions are made by the Decentralized Autonomous Organization (DAO). The DAO allows each masternode to vote once (yes/no/abstain) for each proposal. If a proposal passes, it can then be implemented (or not) by Dash’s developers. A key example is early in 2016, when Dash’s Core Team submitted a proposal to the network asking whether the blocksize should be increased to 2 MB. Within 24 hours, consensus had been reached to approve this change. Compare this to Bitcoin, where debate on the blocksize has been raging for nearly three years.

DAO also provides a means for Dash to fund its own development. While other projects have to depend on donations or premined endowments, Dash uses 10% of the block reward to fund its own development. Every time a block is mined, 90% of the reward is split between the miner and a masternode per the distribution found here, while the remaining 10% is not created until the end of the month. During the month, anybody can make a budget proposal to the network. If that proposal receives net approval of at least 10% of the masternode network, then at the end of the month a series of “superblocks” will be created. At that time, the block rewards that were not paid out (10% of each block) will be used to fund approved proposals. The network thus funds itself by reserving 10% of the block reward for budget projects.

You can read more about Dash governance in the Governance section of this documentation.

Sentinel¶

Introduced in Dash 0.12.1, Sentinel is an autonomous agent for persisting, processing and automating Dash governance objects and tasks. Sentinel is implemented as a Python application that binds to a local version dashd instance on each Dash masternode.

A Governance Object (or “govObject”) is a generic structure introduced in Dash 0.12.1 to allow for the creation of Budget Proposals and Triggers. Class inheritance has been utilized to extend this generic object into a “Proposal” object to supplant the current Dash budget system.

Diagram highlighting the relationship between Dash Sentinel and Core¶

Fees¶

Transactions on the Dash network are recorded in blocks on the blockchain. The size of each transaction is measured in bytes, but there is not necessarily a correlation between high value transactions and the number of bytes required to process the transaction. Instead, transaction size is affected by how many input and output addresses are involved, since more data must be written in the block to store this information. Each new block is generated by a miner, who is paid for completing the work to generate the block with a block reward. In order to prevent the network from being filled with spam transactions, the size of each block is artificially limited. As transaction volume increases, the space in each block becomes a scarce commodity. Because miners are not obliged to include any transaction in the blocks they produce, once blocks are full, a voluntary transaction fee can be included as an incentive to the miner to process the transaction. Most wallets include a small fee by default, although some miners will process transactions even if no fee is included.

The release of Dash 0.12.2.0 and activation of DIP0001 saw a simultaneous reduction of fees by a factor of 10, while the block size was increased from 1MB to 2MB to promote continued growth of low-cost transactions even as the cost of Dash rises. Dash 0.13.0.0 introduced InstantSend autolocks, which caused masternodes to automatically attempt to lock any transaction with 4 or fewer inputs — which are referred to as “simple” transactions — and removed the additional fee for InstantSend. 0.14.0.0 then removed the limitation on 4 inputs, so the network will attempt to lock all transactions. The current fee schedule for Dash is as follows:

Transaction type |

Recommended fee |

Per unit |

|---|---|---|

CoinJoin |

0.001 DASH |

Per 10 rounds of CoinJoin (average) |

All other transactions |

0.00001 DASH |

Per kB of transaction data |

As an example, a standard and relatively simple transaction on the Dash network with one input, one output and a possible change address typically fits in the range of 200 - 400 bytes. Assuming a price of US$100 per DASH, the fee falls in the range of $0.0002 - $0.0004, or 1/50th of a cent. InstantSend locking will be attempted on all transactions without any extra charge.

CoinJoin works by creating denominations of 10, 1, 0.1, 0.01 and 0.001 DASH and then creating CoinJoin transactions with other users using these denominations. Creation of the denominations is charged at the default fee for a standard transaction. Using CoinJoin is free, but to prevent spam attacks, an average of one in ten CoinJoin transactions are charged a fee of 0.0001 DASH. Spending denominated inputs using CoinJoin incurs the usual standard fees, but to avoid creating a potentially identifiable change address, the fee is always rounded up to the lowest possible denomination. This is typically 0.001 DASH, so it is important to deduct the fee from the amount being sent if possible to minimise fees. Combining InstantSend and CoinJoin may be expensive due to this requirement and the fact that a CoinJoin transaction may require several inputs, while InstantSend charges a fee of 0.0001 DASH per input. Always check your fees before sending a transaction.

Evolution¶

Dash Evolution is the code name for a decentralized platform built on Dash blockchain technology. The goal is to provide simple access to the unique features and benefits of Dash to assist in the creation of decentralized technology. Dash introduces a tiered network design, which allows users to do various jobs for the network, along with decentralized API access and a decentralized file system.

Dash Evolution will be released in stages. Dash Core releases 0.12.1 through to 0.12.3 lay the groundwork for the decentralized features behind the scenes. Version 0.13 introduces the foundation of Evolution, specifically DIP2 Special Transactions and DIP3 Deterministic Masternode Lists. Version 0.14 establishes DIP6 Long Living Masternode Quorums. Expected in late 2019, Dash Core 1.0 will introduce key Evolution features such as username-based payments, the world’s first decentralized API (DAPI) and a decentralized data storage system (Drive) based on IPFS.

Included below is our current work on Evolution, that adds many components such as:

Drive: A decentralized shared file system for user data that lives on the second tier network

DAPI: A decentralized API which allows third tier users to access the network securely

DashPay Decentralized Wallets: These wallets are light clients connected to the network via DAPI and run on various platforms

Second Tier: The masternode network, which provides compensated infrastructure for the project

Budgets: The second tier is given voting power to allocate funds for specific projects on the network via the budget system

Governance: The second tier is given voting power to govern the currency and chart the course the currency takes

Deterministic Masternode Lists: This feature introduces an on-chain masternode list, which can be used to calculate past and present quorums

Social Wallet: We introduce a social wallet, which allows friends lists, grouping of users and shared multisig accounts

Evolution Previews¶

Dash Dapps - Demoing Community Development on environment, 17 August 2020

Let’s Talk Dash Dapps feat. Sample Dapps & Wallet API (Ep 2), 6 August 2020

Let’s Talk Dash Dapps feat. Chrome Wallet (Ep 1), 28 July 2020

The following videos featuring Dash Founder Evan Duffield and Head of UI/UX Development Chuck Williams describe the development process and upcoming features of the Dash Evolution platform.

Evolution Demo #1 - The First Dash DAP, 16 March 2018

Evolution Demo #2 - Mobile Evolution, 25 April 2018

Evolution Demo #3 - Dashpay User Experience, 15 May 2018

Chuck Williams on Evolution, Dash Conference London, 14 September 2017

Evan Duffield on the Evolution Roadmap, Dash Force News, 28 June 2017